Cusi defends foreign capital requirement for geothermal projects

- November 17, 2020

- 0

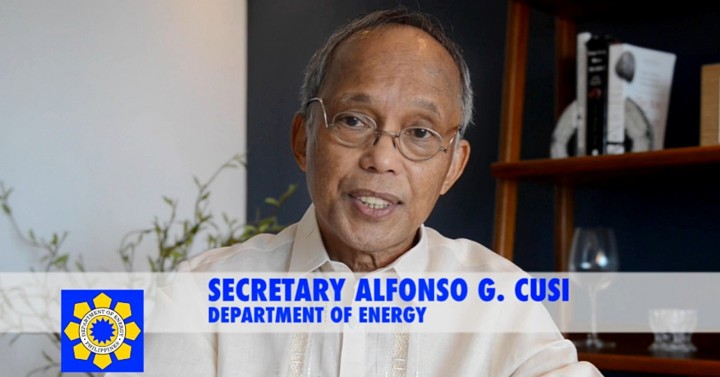

Energy Sec. Alfonso Cusi defended the $50 million capital requirement for foreign companies entering the country’s geothermal sector, which was deemed to be “negligible.”

Cusi pointed out that $50 million has been the amount the government has seen to be attractive to investors.

The secretary was reacting to criticisms that the said capitalization amount is deemed as a small-scale or “tiangge” price compared to the much larger price for exploring and developing geothermal resources.

Industry players noted that such scale of capital infusion pales in comparison to values of geothermal energy assets previously divested by government-owned Power Sector Assets and Liabilities and Management Corporation (PSALM).

Among the former PSALM assets divested were the Makiling-Banahaw and Tiwi facilities that were sold in 2008 to AP Renewables of the Aboitiz group for $446 million.

Cusi explained that the Department of Energy set a lower investment requirement for foreign firms to shore up competition with local players. Aside from the Aboitiz group, the Lopez group by way of First Gen Corporation dominate the Philippine geothermal sector. Meanwhile, Sy-owned Philippine Geothermal Production Company is listed as a key player for geothermal exploration.

The energy chief hopes that increased competition would speed up the development of the country’s geothermal resources for power purposes.

Photo from the Philippine News Agency.