IN FOCUS: Why developing solar + storage in ASEAN is closer than you think

- September 13, 2018

- 0

Outlook:

As the cost of global photovoltaic systems declines and the policy subsidies continue to weaken, many PV leaders in China, such as Trina Solar, Huawei, TBEA, Sungrow, GCL, and ZTTES, have embraced energy storage in their business models, cutting into the storage market in terms of providing EPC services, acquiring battery companies, and even equity investing in storage projects.

The ASEAN region is home to 640 million people. As one the most dynamic entities in the whole world, how’s the potential to develop solar + storage system in the market? And how to seize the most market share before your competitors are in place?

Current Status of ASEAN Solar Market & Chinese Players’ Strategy

According to the World Bank, there are 130 million inhabitants in the entire ASEAN region who do not have access to electricity, and 16 million people in the Philippines who have limited access to electricity. Undoubtedly the market demand is huge.

While the renewable energy revolution is on an explosive growth path across ASEAN, however, it appears that the PV industry is losing supportive incentives from governments. Many traditional PV giants in China are thus forced to transform, adding storage in their offerings so as to ensure long-term revenue stability.

Aimed to be the first few who manage to establish “solar + storage” track records and right kinds of “Participation Model” in ASEAN, most of the Chinese players bring capital to the table, looking for suitable projects with IRR ranging from 6%-15%.

Philippine Islands Provide Enough Revenue for Energy Arbitrage.

Considering revenue streams of energy storage projects, what can be easier than arbitrage: buy low, sell high?

Energy arbitrage is the practice of purchasing and storing electricity during off-peak times, and then utilizing that stored power during periods when electricity prices are the highest. As prices on power storage batteries have dropped significantly over the past decade, the option to introduce energy arbitrage as a cost savings method has become increasingly appealing to many industrial and commercial consumers, especially for those who make a living in the Philippines.

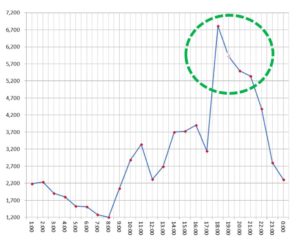

Philippine electricity tariff ranks the highest in ASEAN and the second highest in Asia. Especially in tourist islands, for example, daily wholesale electricity price differentials in Boracay, Philippines’s renowned tourist spot, reaches USD$ 10.4 cents/kwh, a 6:1 power ratio, which makes energy arbitrage revenues become more than sufficient to support the storage investment. Moreover, investor’s don’t have to worry about the creditability of the electricity buyers, due to the economic dynamics and excess demand of power in such kind of islands.

There are over 1700 tourist islands in the Philippines and around 10 will be strategically developed in the coming years.

Perspectives from the Capital Market:

At present, one reason that some PV companies hesitate to enter into the storage market lies in their uncertainty about the capital market’s attitude.

The current payback period of a lead-acid battery storage project is about 6-8 years, and the lithium-ion battery storage systems would need about 8-10 years. Solar project, instead, yields a shorter payback period of 4-5 years, which makes it a more profitable option compared to battery storage. More revenue returns, more appealing to the investors.

But for long-term renewable energy companies, the inevitable reduction of PV projects will mean fewer and fewer good-quality projects they can find in the future. A new outlet is a must. Meanwhile, according to the industry opinion, battery costs are expected to fall by 20%-30% in one year and 50% in six years, which will drive RoI rate roars for future projects and make storage projects available to the mass.

Therefore, in order to divide the larger “market cake” in the future, there are many energy storage companies with investment capabilities and photovoltaic giants who acquired energy storage enterprises rushing into the market, trying to seize the available cases and equip their team with energy storage development experience. Representative enterprises include: Trina Solar, Huawei, TBEA, Sunshine Power, GCL, Narada, ZTTES, etc.